For Alvin S., retirement means time well spent. Time with his grandchildren. Time with neighbors and friends. Time enjoying the close-knit sense of community he and his wife, Roseann, found years ago along Black Creek in Clay County.

“We just like the freedom that retirement has given us,” Alvin said.

These days, their free time is often spent loading up their camper and taking trips around the region, enjoying new places without having to travel too far from home. It is a pace of life Alvin appreciates after spending 23 years as an Operations Specialist in the U.S. Navy, a role that required constant focus and precision.

“If you’ve ever seen a war movie, the dark room with all the radar and stuff on the ship, that’s where I worked,” Alvin said.

Alvin and Roseann have been VyStar members since the days of Jax Navy Federal Credit Union. Over the years, their trust in the credit union grew alongside their family and eventually led them to VyStar Investment Services (VIS)*, originally named VyStar Financial Group, which was established in January 2001.

As VIS celebrates its 25th anniversary, its purpose is reflected in clients like Alvin who are enjoying retirement as well as the many other clients who benefit from the broad range of guidance that is available to help them pursue their financial goals.

“We want to let everyone know that we can help them pursue their financial and retirement goals, no matter what phase of life they are in,” said Davida Carter, SVP, VyStar Investment Services. “This includes those who just starting an investment plan to retirement plan distribution to estate planning and much more.”

Meeting Individuals With Personal Guidance

Davida was part of what began as a small operation on Jacksonville’s westside and has grown into a full-service brokerage firm offering holistic financial planning. Today, VIS services about $2 billion in assets through its broker-dealer LPL Financial and is supported by more than 20 financial advisors.

VIS offers goal setting and financial planning, college savings and 529 plans, legacy and estate planning and more. The focus is on building lasting relationships so advisors can offer guidance as clients’ needs evolve over time.

Alvin works with financial advisor Wade Bramlitt. Their families have lived a stone’s throw away from one another on Black Creek for years, a connection that helped build familiarity and trust.

“It is nice having someone you can relate to doing your investment services for you,” Alvin said. “He knows … what we’re trying to do. We’re trying to make sure that we’ve got enough money to last out our retirement years.”

Alvin added: “I’m sure it’s not a requirement to know your financial advisor since he was a teenager or younger, but it doesn’t hurt, either.”

That sense of understanding and personal connection is echoed by Anne and Larry R., who began working with financial advisor Rick Gregson in 2009 as they prepared for retirement.

Confidence Passed Down Through Generations

Anne and Larry’s connection to VyStar spans generations. Their parents were among the early members of the credit union while working at Naval Air Station Jacksonville, and that history shaped their confidence in choosing VyStar Investment Services.

“They were in the service, and that’s how they became members,” Anne said of their parents. “Then when we were born and got a little bit older, they decided to open us an account. So what did we do? When our kids got a little older, we opened them an account.”

Their relationship with the credit union led to being referred to VIS and working with Rick.

“He’s been fantastic,” Anne said. “He cares about our goals. He cares about us as people. He cares about our family members. It’s the way VyStar started years ago.”

Planning with VIS, she said, extends well beyond the present.

“He doesn’t just look at us,” Anne said. “He looks at how this will affect our family. He’s planning for everything.”

Comfort When Discussing Finances

For many people, money can be a difficult subject. Conversations about retirement, long-term care or family finances often come with stress and uncertainty. For clients working with VIS, those conversations are designed to feel different.

“It’s a calming thing to talk about,” Anne said. “Most of the time money is stressful for people. When you have advisors like Rick, you don’t feel that stress from it. Because if they explain it well and they cater to what your comfort level is, you don’t feel stressed about it. We walk away and we go, ‘This is good for us.’

That calm comes from patience and clarity.

“It’s always very explanatory,” Anne said. “You hear it, but sometimes you need to hear it again. The next time we see him, ‘Can you go over it again and tell us exactly what this money is doing?’ He’s great about it. He understands. He never makes us feel bad when we ask a question.”

Knowing those conversations are always available adds another layer of reassurance.

“It’s a comfort,” Anne said. “We know we can pick up the phone, leave a message and he will get right back to us.”

That same sense of comfort resonates with Alvin.

“If you feel comfortable with the person you decide to choose and you feel like that person has your best interest at heart, that’s a good place to start,” he said.

These stories are examples of the experience clients can expect from VIS. Advisors who listen. Guidance that evolves as life changes. And relationships built over time, with a focus that never strays from helping clients feel more confident in their future.

“We feel honored that Alvin and Roseann, Anne and Larry, and so many others have relied on us to deliver sound financial coaching to reach all their many goals in life,” Davida said.

Looking Ahead

The growth of VIS is because of the relationships clients have with their advisors. Regardless of financial status, all clients are made to feel welcome.

For Anne, that approach makes all the difference.

“People should really consider it,” she said. “You don’t feel like you have to have ‘X’ amount of dollars. Well, that’s not really fair that some places won’t take you if you don’t have $500,000 or whatever it is they want.”

Added Larry, “We don’t hesitate to recommend them to anyone.”

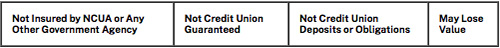

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. VyStar Credit Union and VyStar Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using VyStar Investment Services and may also be employees of VyStar Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, VyStar Credit Union or VyStar Investment Services. Securities and insurance offered through LPL or its affiliates are:

*Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.