I’ll never forget the excitement of those initial conversations. Visiting one branch after another, I saw the same spark in the eyes of our employees as I shared the news: soon, members could receive investment guidance from advisors located at our credit union, those they knew and were comfortable with. There was relief in those rooms. Pride, too. It never felt right to send members elsewhere for something as personal and important as planning for their financial future.

Those early days weren’t just busy. They were exhilarating. In our first year, the four advisors and two support staff I hired had calendars packed from morning to evening. Members were eager to sit down and talk through their most personal financial goals, often for the first time. Many had never been shown there were options beyond CDs, savings accounts and money markets or given education to understand how different strategies could support their long-term plans.

The work was demanding but meaningful. The importance of what we were building carried us through those long days (so did the coffee). As VyStar Investment Services* celebrates our 25th anniversary, I can still feel the momentum and responsibility that defined those early years. It carries us forward as we look to the future.

Why Our Work Matters

My connection to our work dates back even further. I had been a Jax Navy Federal Credit Union member for decades before leading VyStar Investment Services, and I had seen how often members were referred out for investment guidance and then pressured to move their broader financial relationships elsewhere. I knew there was a better way. Members should be able to fully pursue their financial goals at the same location where they maintain their credit union relationship. At its core, this work has always been about helping people make sense of important decisions at pivotal moments in their lives.

Over the past 25 years, our work has evolved alongside the needs of those who come to us for financial guidance. One of the most significant shifts since then has been around retirement. Today, it’s no longer just about preparing for retirement, but about navigating it thoughtfully. With pensions largely a thing of the past and longer life expectancies becoming the norm, the distribution phase of retirement has become just as important as the accumulation phase.

Beyond retirement, our work shows up in many different moments. Whether someone is planning for a child’s education, caring for aging parents, navigating complex family decisions or simply looking for clarity during a moment of change, our role remains to meet people where they are and help them think through what comes next.

A Story That Stays With Me

Amid thousands of conversations over the years, one story has always stayed with me. Early on, a young enlisted sailor came in because he wanted to be proactive about his future. He didn’t know where to start, so we started together. We talked through his options, including contributing to his Thrift Savings Plan through the Navy and opening a Roth IRA alongside it. Each year, we met again. As his career progressed, we adjusted the plan. When he explored real estate opportunities, we talked through those, too, all while steadily increasing his savings. Years later, that sailor retired as an officer and had accumulated his retirement funds through consistency, education and an approach he understood.

Stories like this mean so much to me, each in their own way. It is truly a privilege to support individuals and families with their own aspirations, challenges, hopes and dreams. There is no doubt it has been the highlight of my career.

Offering Support in the Years Ahead

When I look back on these 25 years, what I am most proud of is the team we have built. In 2026, VyStar Investment Services has several Certified Financial Planners, Chartered Retirement Planning Counselors and Accredited Investment Fiduciaries, and we service nearly $2 billion in assets. We have advisors and support staff at every stage of their careers, united by a shared commitment to provide thoughtful guidance to individuals and families, regardless of where they are starting from.

To those who have looked to us for guidance over the years, thank you for allowing us to be part of your journey. And to the employees who have shown up every day with care and determination, this milestone belongs to you as well.

As we look ahead, it remains our honor to support members in pursuit of their financial goals, one day and one conversation at a time.

Davida Carter

SVP, VyStar Investment Services

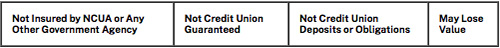

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. VyStar Credit Union and VyStar Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using VyStar Investment Services and may also be employees of VyStar Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, VyStar Credit Union or VyStar Investment Services. Securities and insurance offered through LPL or its affiliates are:

*Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.